We are living in turbulent times. COVID-19 is leading to what is likely to be one of the greatest economic recessions we have ever seen. Governmental policies, in the forms of the slashing of interest-rates and unprecedented quantitative easing. For any investor, but especially an investor in a commodity as gold that rises in price during a time of crisis, it is vital to understand the fundamental framework which determines such economic policy. This framework determines the mode of thought and thus action of both government officials and investors. To grasp this framework is to understand what determines the unspoken assumptions of economic reasoning, what is seen as valid economic reasoning and the legitimacy of economic ideas and how they are implemented. This article therefore discusses the dominant framework of today, that of neoliberalism.

What exactly is neoliberalism? Michel Foucault, arguably the most influential philosopher of the 20th century, explains how it entails a complete overhaul of what we consider to be legitimate forms of intervention by the government. During the middle-ages, governments extensively regulated and actively intervened and in the market to create more just outcomes. An example of this is the introduction of a “just price”, which set such as to give a livable wage to the workers, a fair profit to the merchant but was still affordable to the buyer. If you are an economist and you read the last sentence, you likely considered it to be sounding awfully inefficient. However, how do you determine what is efficient and what is not? When assessing efficiency, you are using a framework introduced in the middle of the 18th century by the Physiocrats and the Classical Political Economists. In their perspective, the economy was in a state of efficiency when it left alone by the government; this proposition is commonly known under the term of “laizzes-faire” or the night-watchmen state.

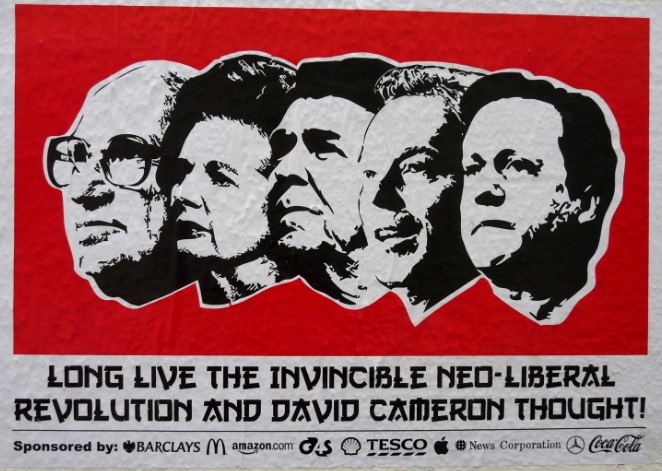

During the period 1930s-1980s, a new mode of economic thought rose to dominance known as Keynesianism. In this mode of economic thought, active government-intervention and stimulus were actually validated on grounds of achieving efficiency; for an economy to recover from a state of a slump, governmental stimulus is required to lift the expectations or “animal spirits” of investors. However, the Keynesian was invalidated in the economic thought-collective by the stagflation in the 1980s. From its ashes emerged neoliberalism, and it has been the dominating political and economic thought ever since. To borrow a computer-analogy by the economist Mark Blyth, if the physical capital is the “hardware” of the economy, this shift was an update of its “software”. In this mode of economic thought, all governmental practices and interventions as assessed in market-terms. It entails speaking of citizens as “customers” of governmental services by civil servants and the introduction of “competition” and “the laws of the market” not only in the economy, but also in society and government. In other words, the fundamental goal of the government becomes to increase efficiency by increasing the extending the competitive working of the market-mechanism in the economy, society and the government.

However, and this is fundamental to understand for investors, neoliberalism in practice and theory are almost two opposite forces; neoliberalism in practice entails not a reduction but an extension of governmental intervention. The closest analogy to it is that of doublethink from Orwell’s dystopian novel 1984, where it entails the acceptance of truth that clearly contradicts reality. To ensure the workings of the market (approach) the way markets work as explained in economic textbooks, extensive intervention is required. Conditions must be set to ensure the competitiveness of the market. This means that in practice, size and intervention of government will actually increase under neoliberalism.

Furthermore, the deregulation of the financial market, for the market must regulate investors, not the government, and the focus on “shareholder-value” means markets will increasingly be ruled by “short-terminism”. Inevitably, this will cause financial markets to blow-up, as shown by the Great Recession in 2007-2009. Even within a neoliberal framework, the government cannot allow the complete annihilation of the economy, even if, from a neoliberal perspective, eventually a stronger economy will arise from its ashes. This is because the latter is especially contradicted by the experience in the 1930s, a memory that even neoliberal doublethink cannot disregard or erase. We can therefore expect the quantitative easing to continue, while it is being justified in neoliberal doublespeak.

Lastly, the extension of the market meant the slashing of social spending as unemployment-benefits, labour market institutions as trade-unions and in the name of efficiency. This has led to sky-rocketing wealth and income inequality, leading to increased tensions worldwide. Both left-wing and right-wing parties, arguing from a political neoliberal framework, cannot solve (perhaps not even halt) this process. This has been an important contributor to the rise of the alt-right, who blame results of neoliberalism combined with technological change (of which the unequalizing effects cannot be countered in a neoliberal framework) as stagnant wages for the bottom quartile on immigrants. They too cannot solve these issues, which will most likely only be amplified by their decrease in government-intervention. COVID-19 and the death of George Floyd are the tipping-point, the tinder which hive lightened the fires of the riots that are currently engulfing the world.

Are there alternatives to neoliberalism? The answer to that is a resounding yes. Changing neoliberalism requires us to change the fundamentals of economic thought. The ideas of the basic models of economic thought, that minimal government is required for economic efficiency, is often proven to be false by more complex economic models. Furthermore, there are numerous lesser-known schools of economic thought that advocate profoundly different ideas on the role of government and the meaning of efficiency. To change the fundamentals of our economic thought, we must start at its root; the education system. We need to inform and let students engage with different fundamentals.

Disclaimer: These comments on neoliberalism are of Koen Smeets personally. This piece represents his personal opinion and thus does not necessarily reflect Rethinking Economics’ opinion on the topic.

Want To Know More?

Are you interested in discussing these kind of topics? Check out rethinkingeconomics.org or send Koen Smeets personally a message on koen@rethinkingeconomics.nl