As one of the most wealthy nations in Europe the Netherlands positions itself as best in class in the European Union. However, this pride cannot be rhymed with its banana-republic tax system which is still a haven for tax-evading multinationals. Rising inequity in the nations is largely the results of inadequate housing market regulations. The over-liberalization of the housing market is resulting in record-high housing prices, even when corrected for inflation and the low-interest rates the population dense country is performing worse than other European Nations in terms of affordable housing.

Non-Capital Owning Starters Get Squeeze Out

Simultaneous subsidization and privatization has made housing in the Netherlands a hot investment market which currently comes at the cost of starters without “jump-start capital”. Those who aren’t next-of-kin of capital holding parents face rising rent, while being unable to finance a home themselves. This has led to the unsustainable situation in which non-capital owning individuals spent larger parts of their income paying off the mortgages of housing market investors. The simultaneous rise of rent and housing prices is squeezing out equity out of non-capital owners juicing-up house owners as prices rise.

Counter-Effective Policies Have Made The Problem Worse

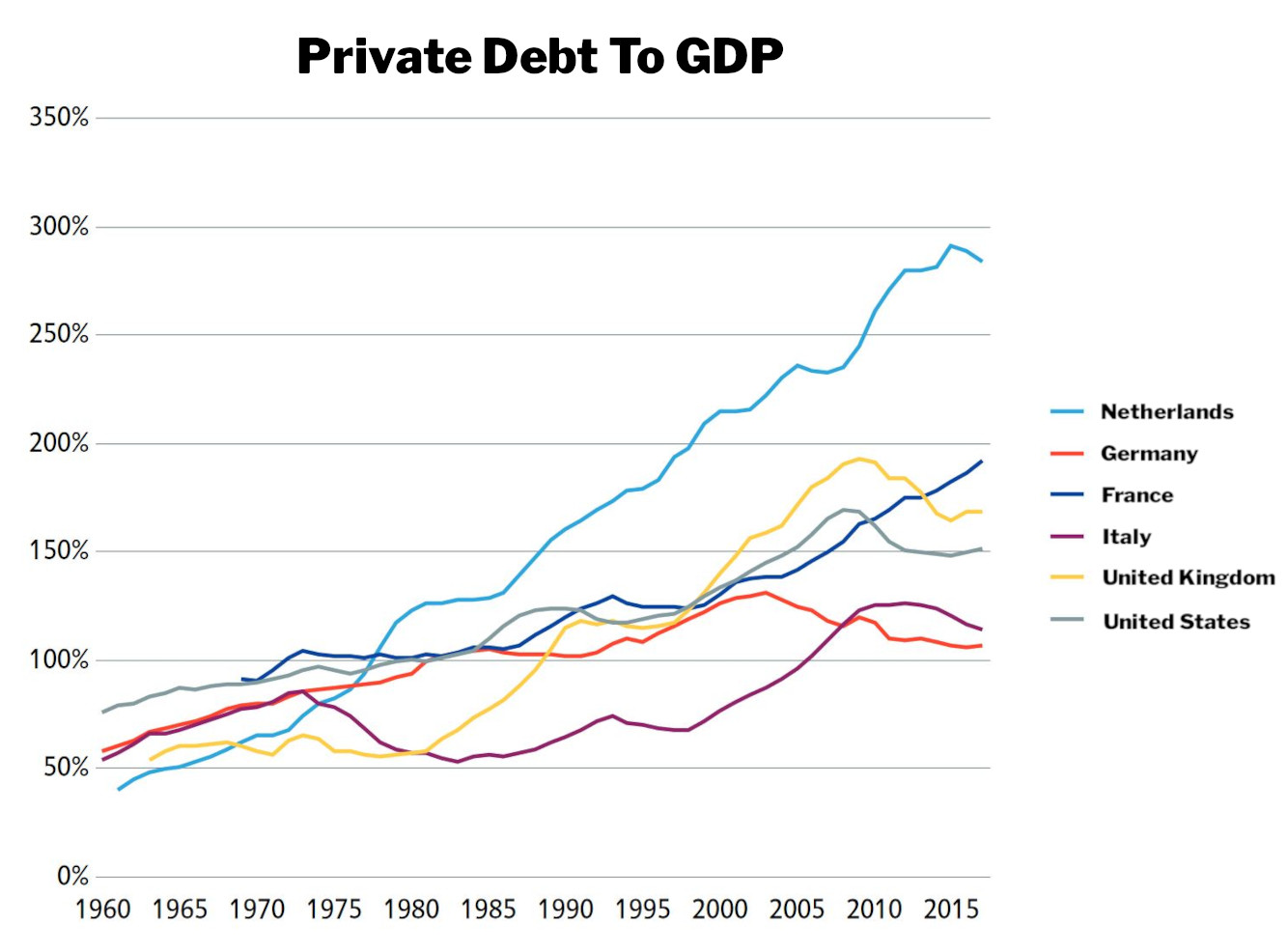

Important to note in this debate is that all policies which boost the sales of houses indirectly is a tax on non-capital owners and a subsidization for home-owners. Take the mortgage interest deduction: as all starters can deduct mortgage interest costs from their tax bracket, this simply leads to higher bids for the houses of capital owning home owners. By the same reasoning transfer tax cost deduction for starters has simply led to higher earnings for home owners as these measures are counter-effective. The failure of the system is also visible by the high levels of Dutch private debt as the already relatively scarce housing market. Over 75 percent of the houses that come on the market are sold either at the asking price or above. Therefore, from the start of this year investors have to pay 8 percent in transfer tax, which will sooth the pressure slightly.

Ending The Inflationary Cycle Is Not Easy

Reversing this trend will could potentially lead to falling housing prices which will cause an immense shock to the over-indebted nation, potentially bringing Dutch banks in problems. The first steps have been taken to limit house market investors to buy houses just to rent it out again by imposing rental prohibitions in the first years after purchase, as these kind investors are increasingly responsible for rising house prices in some cities. However, the question remains whether these kind of policies will improve the current situation.

Real solutions that would cool down the housing market will have price declines as consequence, as the market is currently in a bubble. This will leave many home owners with debts higher than their mortgage collateral, e.g. their home. The already struggling Dutch banks, suffering from the negative ECB interest rates, would come under increasing pressure. Interestingly, the only solution to help out banks in such scenario would be to increase interest rates again, but that would put the banks under different pressure as companies would default. Bailing-out banks again will be hard as governmental spending is already peaking due to the “corona-related” relief programmes. The only solution remaining would be to finance new debt by new quantitative easing, putting fiat money under increasing viability pressure as commodities and crypto’s will show its true color.

Dutch Internationalization Efforts Will Only Increase Pressure

Recent plans by government agencies in the Netherlands to increase the influx of high educated internationals to boost innovation will only put housing markets under higher pressure as these expats tend to be young workers and starters on the housing market. IT-experts are wanted in the Netherlands as the nation has one of the fastest internet connections within Europe. Interestingly, one the main reasons for internationals to leave the Netherlands is the healthcare system, as general practitioners often lack the expertise to make appropriate decisions but do have to decide whether you get to see a specialist. However, expats seem to come to the Netherlands more and more as expats receive significant tax-cuts in the first years of settling. The influx of expats will only inflate pressure on already rising real estate prices in the Netherlands as these highly educated expats tend to earn significantly more than the average Dutch worker.

There Are Signs Of A 2008-Like Bubble, But A Cool-Down May Come Soon

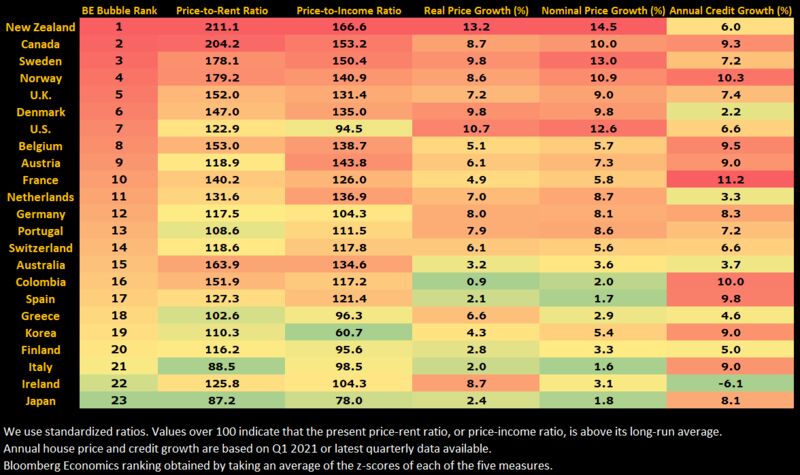

In the graph below, the Bloomberg bubble risk ranking is made in which The Netherlands still seems to abate well. However, the current bottleneck in the Dutch housing market is particularly tight in the starter segment, where home buyers have to overbid ten to twenty percent above asking prices to make a chance. In the higher segments there seem to be no signs whatsoever of bubble forming as family homes are in slightly more abundance available. However, it should be noted that the present situation is not likely to last for long as central banks seemed to be forced to raise interest rates next year for the first time in years. In 2022 as government stimulus dries out, unemployment is most likely to rise higher to above 5 percent of the workforce as a domino-effect of bankruptcies can’t be excluded. And as lending standards are much higher than prior to the 2008 bubble burst, this increased uncertainty will slowdown demand. And as the problem continues to exacerbate political pressure rises, cooling of the housing market could come as soon as the end of 2022. Interestingly, as discussed earlier in 2020 there were less bankruptcies in the Netherlands as in prior years, the likely result of billions of governmental stimulus.

On the short term housing prices will rise further, but within two years the situation can be totally different. Housing prices rise despite of the corona crisis with a double-digit percentage growth rate each year in the Netherlands, last year topping to 12.9 percent from a year earlier. The current situation is unsustainable on the long run, luckily economical dynamics will soon slowdown the growth and re-stabilize the housing market across Europe.

Bibliography

- Prins, J. E. J., & Brom, F. W. A. (2019). Geld en schuld: De publieke rol van Banken. WRR.

- https://www.bloomberg.com/news/articles/2021-06-15/world-s-most-bubbly-housing-markets-flash-2008-style-warnings